A perfect and you will common appeal of all the family in the India was to reside in their dream domestic. Yet not, with real-home rates skyrocketing, its extremely difficult for folks to fund a property with your own money. Finance companies and low-banking boat finance companies give 2 kinds of loan products to greatly help some one see their property fantasies: home loans and you can household construction money. Those two loans render good-sized financial assistance to those appearing to buy a property.

Exactly what ‘s the major difference in both financing sizes? What are the have, qualifications requirements, and financing groups to adopt? This article solutions each one of these concerns and more. Why don’t we make this group already been.

Mortgage brokers compared to. Design Funds A comparison

Now, its relatively easy to become a resident. Any types of domestic we need to purchase, you can aquire the required money by using away property financing. Finance companies and you may property boat loan companies bring multiple lenders. If or not we would like to get a prepared-to-move-in apartment, a less than-structure assets, build a house toward a plot of land, otherwise upgrade your existing home, there are best home loan to your requirements. On the other hand, really consumers get perplexed anywhere between a home loan and you will a house design mortgage. Although the several seem to be similar, there are variations you to definitely individuals need to thought when selecting new appropriate home loan.

What exactly is Mortgage?

A mortgage is basically a binding agreement between both you and new bank so you’re able to use a specific amount of cash in purchase in order to get property. Your commit to pay-off the mortgage along with appeal more a set time frame decideded upon on your part as well as the lender. According to lender, you can choose from a fixed-rate mortgage and an adjustable-rate financial. A mortgage even offers you that have income tax advantages lower than Section 80C of your own Tax Work on your own dominating role. You could make use of tax vacation trips on the appeal repayments below Part 24(b) of Income tax Operate.

What exactly is Household Design Loan?

Property design loan is one where in actuality the lender also provides to fund the expense of creating a separate household. You can both build your domestic toward the homes or create a portion of your residence in your existing property. That it family construction loan could well be available at a predetermined focus rate getting a set period of time. You might customize the name of the construction mortgage predicated on debt ability to pay. The loan was covered once the home is mortgaged best personal loans in Cleveland. There are various form of structure funds, including the following the:

Such fund also are known as one-personal money. They supply the money necessary to create your long lasting home loan once the really since your mortgage.

House framework money, like lenders, has actually income tax advantages. You could claim experts in your dominating and interest not as much as Sections 80C and 24(b) of the Tax Act, correspondingly.

Home loans Versus. Household Structure Funds

Now that you have learned the fresh new definitions regarding home loans and you may home structure finance, it’s time to search higher to learn the distinctions among them. The second dining table compares the 2 style of financing predicated on some parameters.

Loan application Process

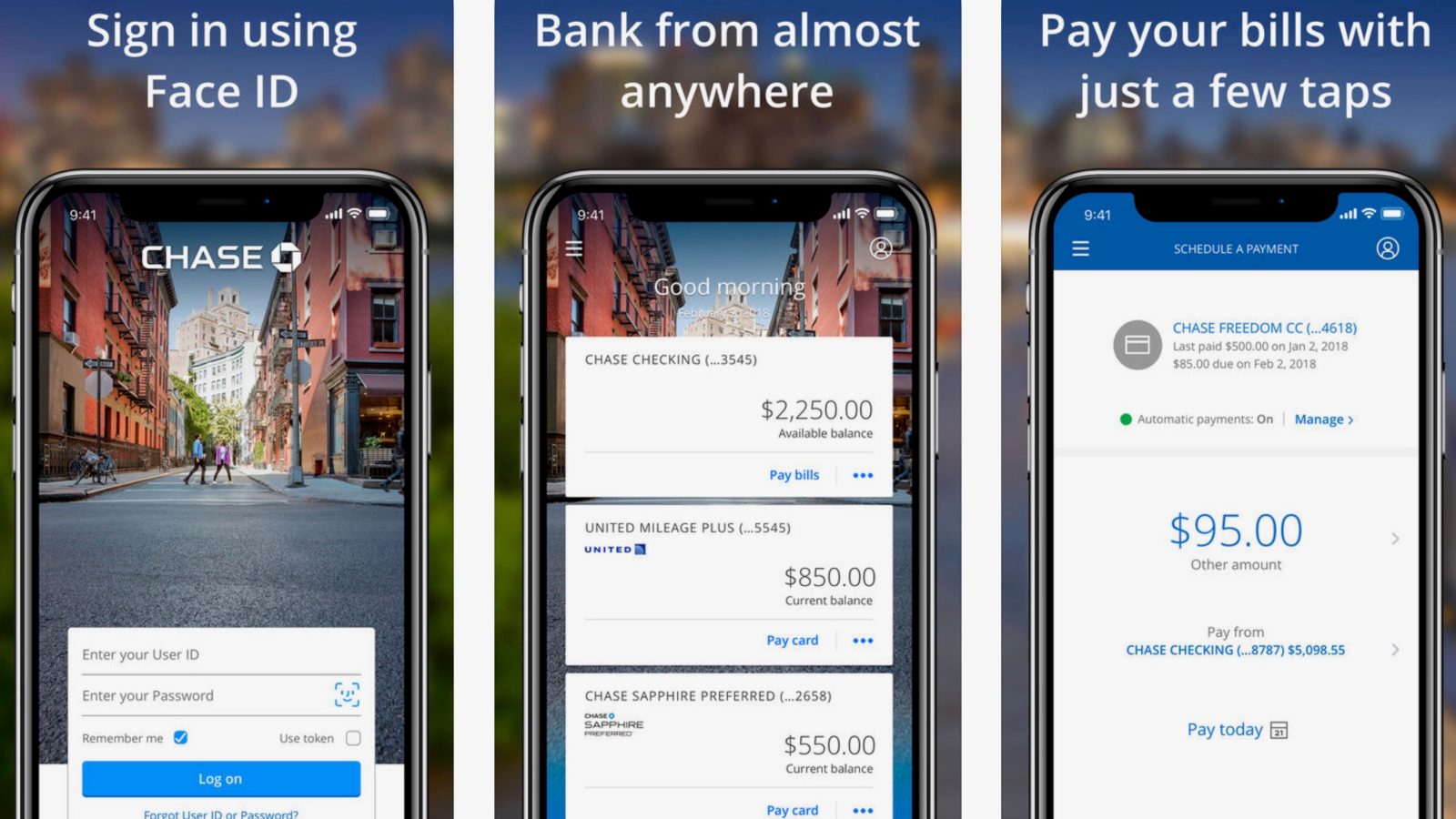

With regards to a basic financial, you can submit an application for they either off-line or on the internet. The program processes to possess a home loan is easy. Only look at the lender’s website or physical area and you can complete aside a mortgage application. The lender often be certain that the home and you can transfer the borrowed funds matter right to the fresh new builder otherwise vendor.

However, if you wish to get a property build loan, the procedure is a tad bit more tricky. You ought to earliest determine whether a loan provider offers property design loan and you can, in this case, what the qualifications requirements was. Domestic build money are typically not available on the internet because they wanted detailed documents and you may files.

Conditions having Qualification and you can Documentation

Lenders generally speaking render mortgage brokers that have easy qualification criteria and you may limited papers. All you have to manage try satisfy some basic requirements such as for example just like the many years, month-to-month earnings, credit history, and stuff like that, along with fill out several easy files just like your Pan credit, Aadhar card, and financial comments. Even if you are located in the economically disadvantaged group, you might see home financing (EWS).

This new qualification conditions and you may documents to have home build money, on top of that, was rigid and go out-taking. A home structure mortgage is just readily available for those who individual a good block of land otherwise a houses assets and wish to build another home.

Records you’ll need for a house build mortgage include the Civil Corporation’s legal agreement files, a property framework out-of an architect otherwise municipal professional, a formula of your own construction, and you can tax submitting data files, among others.

The interest rate

The first thing to keep in mind would be the fact not absolutely all loan providers provide family build funds. And people who manage generally fees a top interest rate. Rates on the household design funds normally range between 10% and you may fourteen% a year.

Home loan interest rates, likewise, are particularly reasonable and you will competitive. Into the India, most banks and you may non-financial financial people (NBFCs) offer lenders. Another reason is the government’s Pradhan Mantri Awas YoAY) program, that renders home loans very affordable. The annual interest on home financing vary ranging from 6% and you can ten%.

This new Loan’s Period

The newest fourth and latest difference between these two sort of financing is their financing period. Mortgage brokers are typically large-well worth loans because they are always pick home. Consequently, lenders may have terms of as much as three decades.

Family structure financing, on top of that, are available for a shorter period of time than home loans. Domestic framework finance normally have terminology between 7 to help you 15 years.

The fresh new Parallels anywhere between Mortgage brokers and House Framework Financing

Though the goal and objective of those loan circumstances differ, there are a few similarities. Loan providers go after the same mortgage sanction techniques if or not your get home financing or a home build financing. Additionally, brand new repayment alternatives and co-applicant regulations are exactly the same for.

Conclusion:

Because you can features guessed, there must be zero distress from inside the choosing anywhere between a mortgage and you will property Design Financing while they serve different aim. The home Financing is advisable if you plan to purchase good based assets or a house that is nonetheless lower than framework off a builder. When the, as well, you need to create your home, you should fit into property Build Financing. Almost any solution you select, we recommend that your make comprehensive browse and you can compare some financial institutions and you can NBFCs just before settling on a lender.