A quick Post on Financial Underwriting

Financial underwriters determine risk. Playing with particular, pre-determined direction, they look at the things such as your credit history, debt-to-money ratio, or other possessions, to figure out if you can be eligible for a mortgage

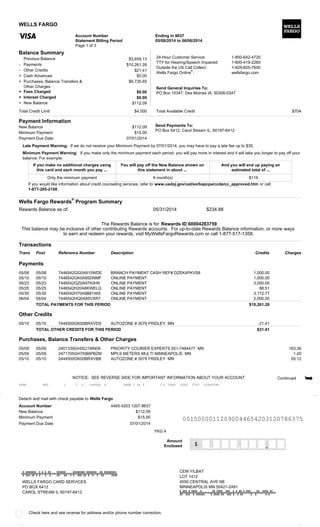

The latest underwriter initiate by the take together all of the records you made available to your loan Administrator. They guarantee your own a career and you can money, check your credit rating, and assess the level of debt you have got with regards to your income.

Brand new underwriter and additionally critiques the house assessment and identity papers and you can confirms which you have the discounts and you can down payment loans you have reported on the software.

According to so it opinion, brand new underwriter will determine if the most of the conditions and you may direction was basically satisfied with the unit/system the place you features used. Even in the event they have not, brand new underwriter sends the loan software back into the mortgage Officer.

Two types of Underwriting

There have been two types of underwriting: automated and you will instructions. Any type of method your loan is actually canned should not improve question. If for example the software is assessed by hand or perhaps in an automated styles possess way more related to the kind of loan program you’ve selected.

- Manual underwriting: At Incorporate, our Jumbo and you will Beyond fund are usually manually underwritten to meet up with particular underwriting direction.

- Automated underwriting: Often referred to as a great dining table approval, automatic underwriting is used so you can processes Fannie mae, Freddie Mac computer, FHA, Va, USDA, or any other conventional funds. Automatic files are analyzed because of the a human first. They are also sometimes relocated to instructions comment so you’re able to describe a specific concern having developed within the automatic review procedure.

New Underwriting Decision

The time involving the distribution of the software and the approval of the mortgage is referred to as the new change go out. Lenders generally promote a 30 to forty five go out turn date.

Underwriting by itself takes from around eight so you can 14 days, based perhaps the techniques is actually automatic otherwise instructions and you will whether or not or not further explanation is necessary with the particular part of their application for the loan. Just after complete, Underwriting tend to send certainly about three verdicts toward Loan Administrator.

- Approved: Whether or not you have been recognized, brand new underwriter might still wanted subsequent explanation off a belated payment, large put, earnings documents, otherwise whatever else that could boost question. For that reason the loan Officer can come back for more information when you believe you used to be over taking invoices, comments, etcetera.

- Reviewed: Delays towards a career verification and other income-related inquiries can cause your loan being examined and you may threaten the closure. Dealing with the situation as fast as possible can get you back on the right track and you may trigger an approval.

- Denied: A mortgage may be denied having a blunder on the app otherwise credit file, so you’re able to difficulties from term or appraisal of the home you desire to buy. An assertion would be defeat of the fixing mistakes on your own application or credit file, making clear resources of income, if not going for an option mortgage program.

Financial Underwriting: The bottom line

Because of so many you should make sure with respect to approving otherwise denying that loan, underwriting is truly where in fact the rubber suits the trail in the real estate loan processes best banks for personal loans with good credit.

To help you facilitate a smooth underwriting comment procedure do not change services, make biggest orders, discover the latest personal lines of credit, or flow large sums of cash from membership towards almost every other. Remain copies of your most of the expected data files and any new comments that already been into the opinion available. A hands-on method and you can small response from you helps to keep the loan application swinging steadily on acceptance.